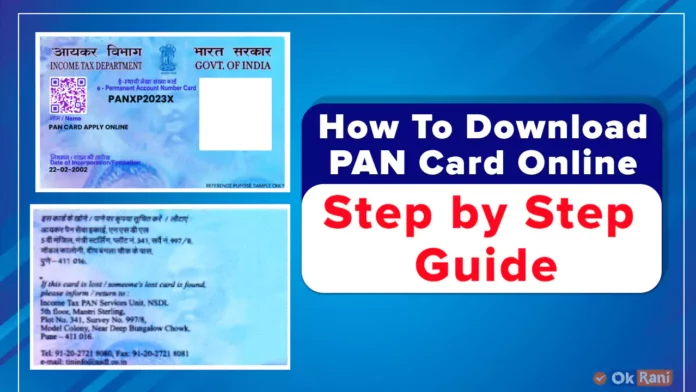

PAN is a ten-digit alphanumeric number which is issued by the Income Tax Department. It is issued as a plastic card known as a PAN card which is shown below. It is common for all the taxpayers. The structure of the ten digits of PAN is described below. The initial three letters out of the first five characters follow the alphabetical order from AAA to ZZZ. The fourth letter in the PAN shows what kind of entity the PAN holder is.

- “P” means Individual

- “C” means Company

- “H” means Hindu Undivided Family (HUF)

- “A” means Association of Persons (AOP)

- “B” means Body of Individuals (BOI)

- “G” means Government Agency

- “J” means Artificial Juridical Person

- “L” means Local Authority

- “F” means Firm/ Limited Liability Partnership

- “T” means Trust

The fifth letter in PAN tells us the first letter of the last name of individuals. For non-individual PAN holders, the fifth letter shows the first letter of the PAN holder’s name.

How to do PAN Card Download PDF?

E-PAN Card Download: The e-PAN card is like the digital version of your physical PAN card. It’s a virtual PAN card that’s handy for e-verification. All your PAN details are in the e-PAN, and you can keep it on your computer or smartphone for easy access. Let’s go through the step-by-step process of getting your e-PAN Card. The download PAN card online can be done by three methods.

- NSDL PAN card Download

- UTIITSL

- Income tax e-filing PAN card download.

NSDL PAN card Download

The NSDL portal offers the facility to download e-PAN for applicants who applied through their website. New PAN applications or those requesting changes can be downloaded at no cost within 30 days of confirmation from the income tax department. After this period, additional charges apply.

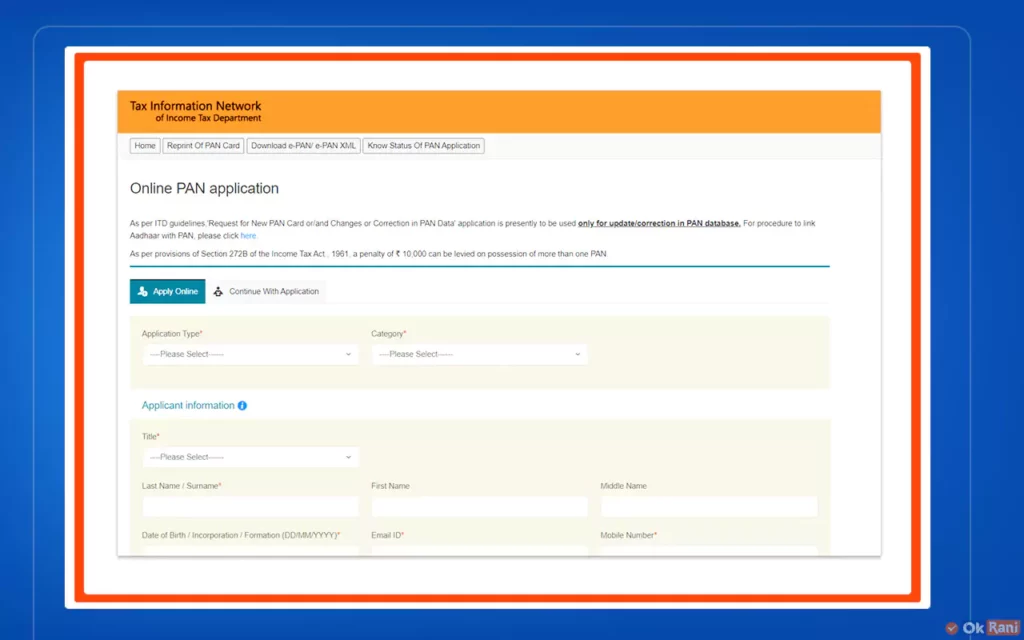

Step 1: Go to the official website NSDL portal.

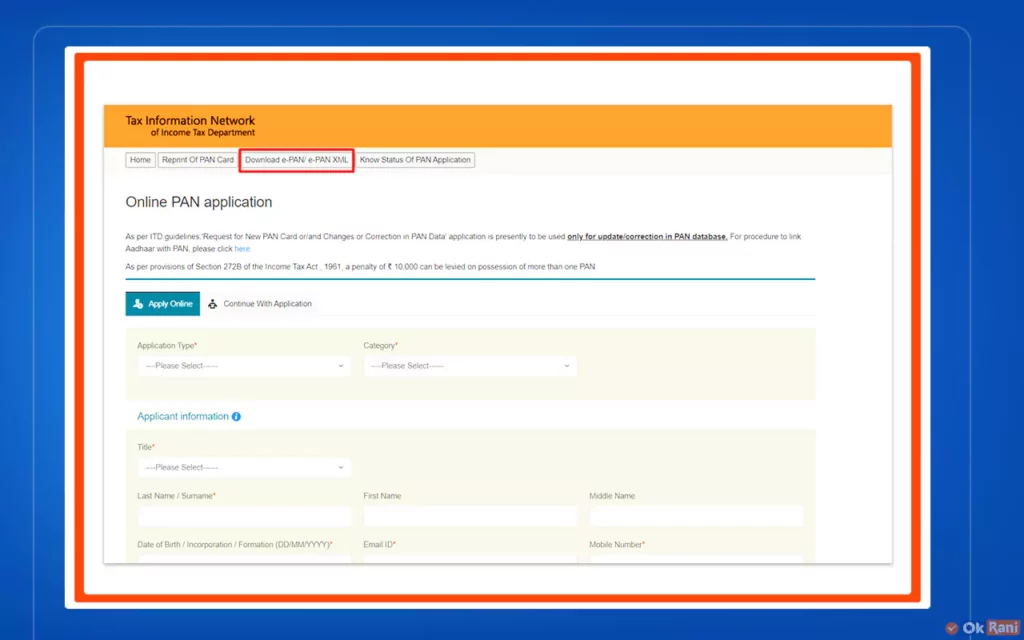

Step 2: Now click on the Download e-PAN/e-PAN XML button.

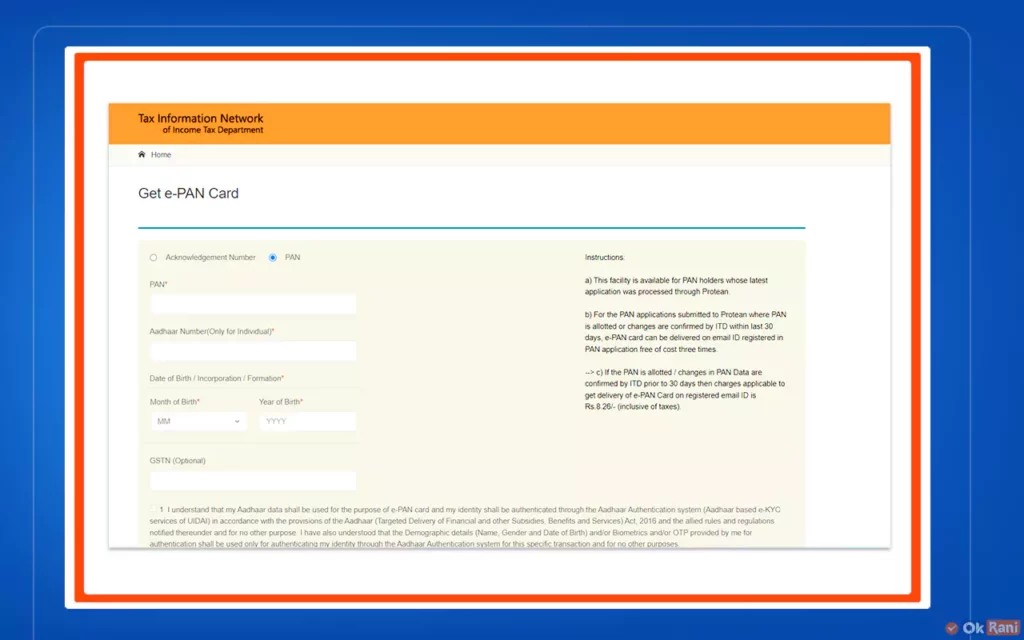

Step 3: On this page, we have to fill in the details like PAN number, Aadhaar Number(Only for Individual)*, Date of Birth / Incorporation / Formation*GSTN (Optional), and then click on the Submit button.

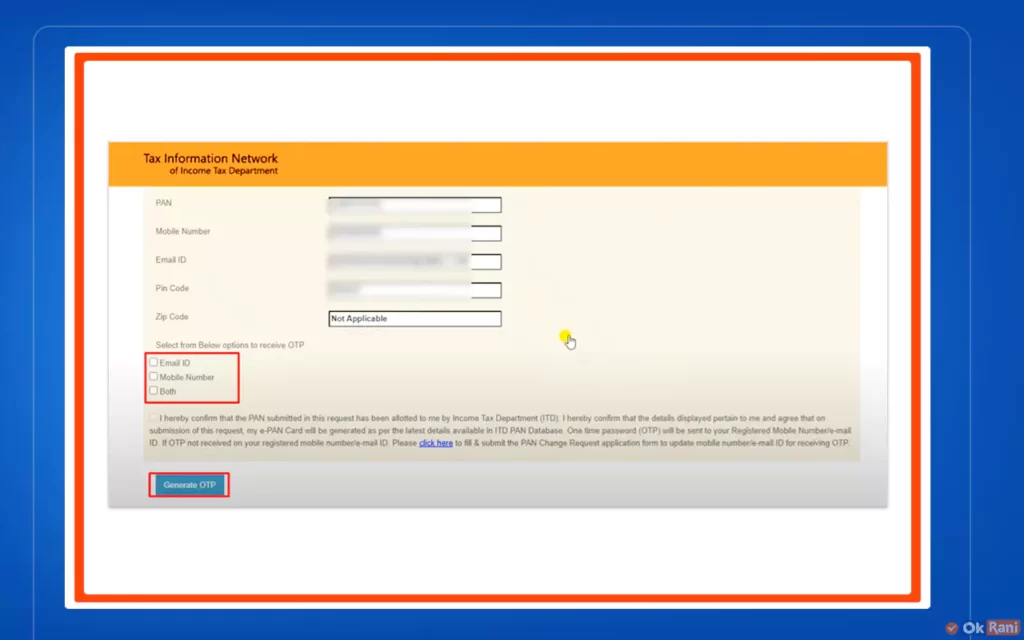

Step 4: After submission, the PAN number, Mobile number, email ID, postal code, and Zip code will be displayed on the screen. Now click on the checkbox of Email ID or Mobile number or both to receive an OTP.

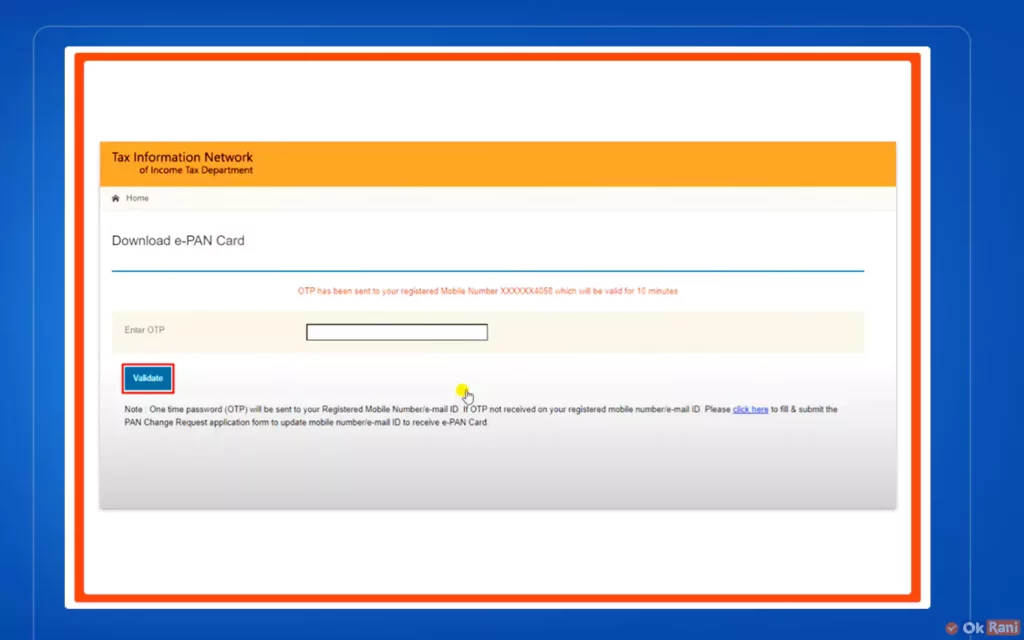

Step 5: Enter the OTP, you have on Mobile or email ID or both in the “Enter OTP” column and click on the Validate button.

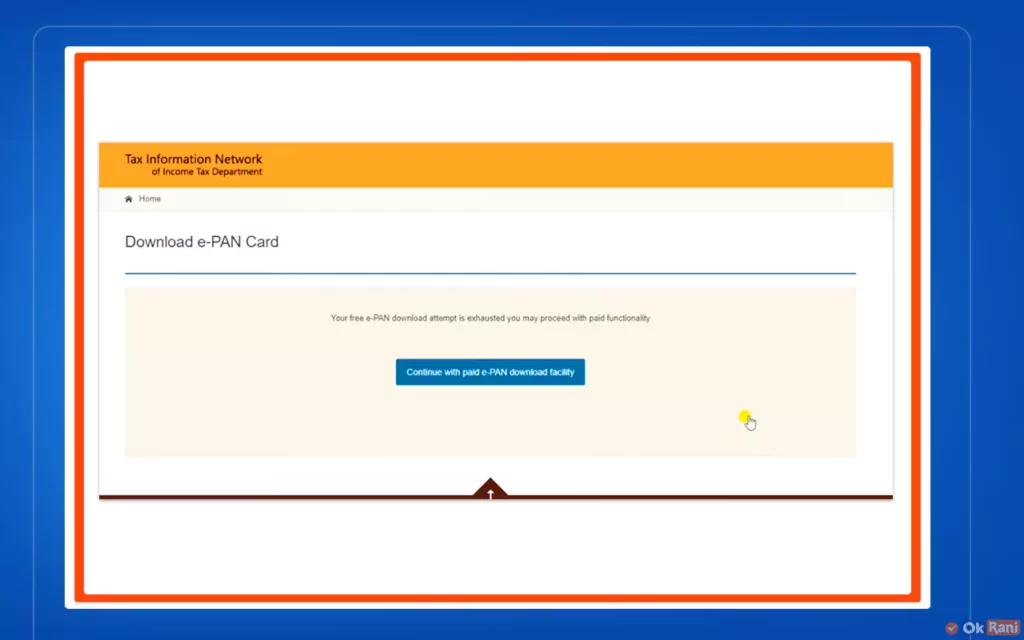

Step 6: If your free PAN download has expired, then you have to pay an amount of Rs.8.26. otherwise, you can download it directly in a pdf format.

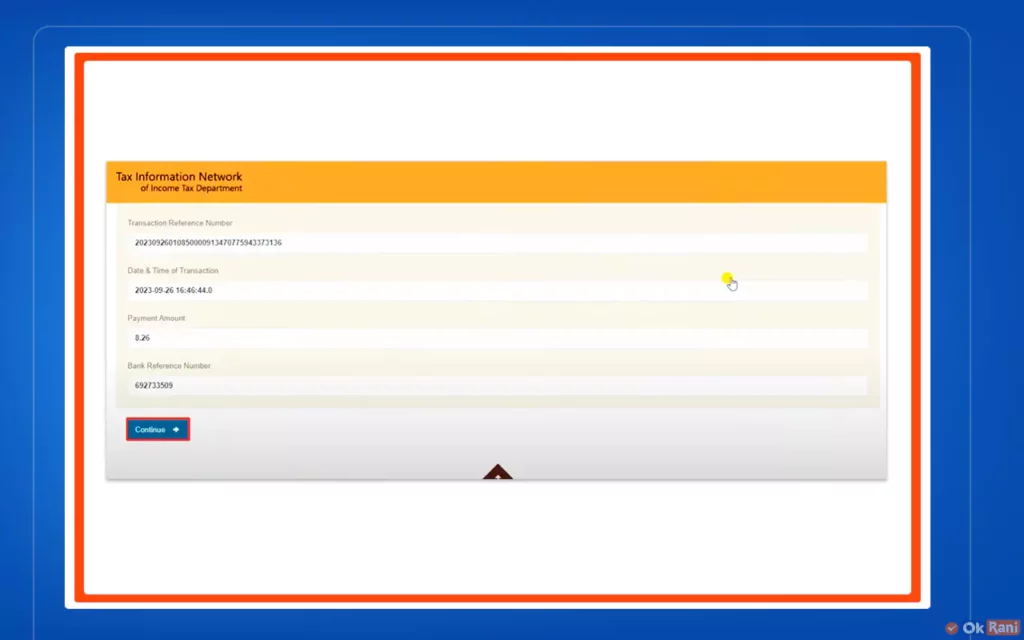

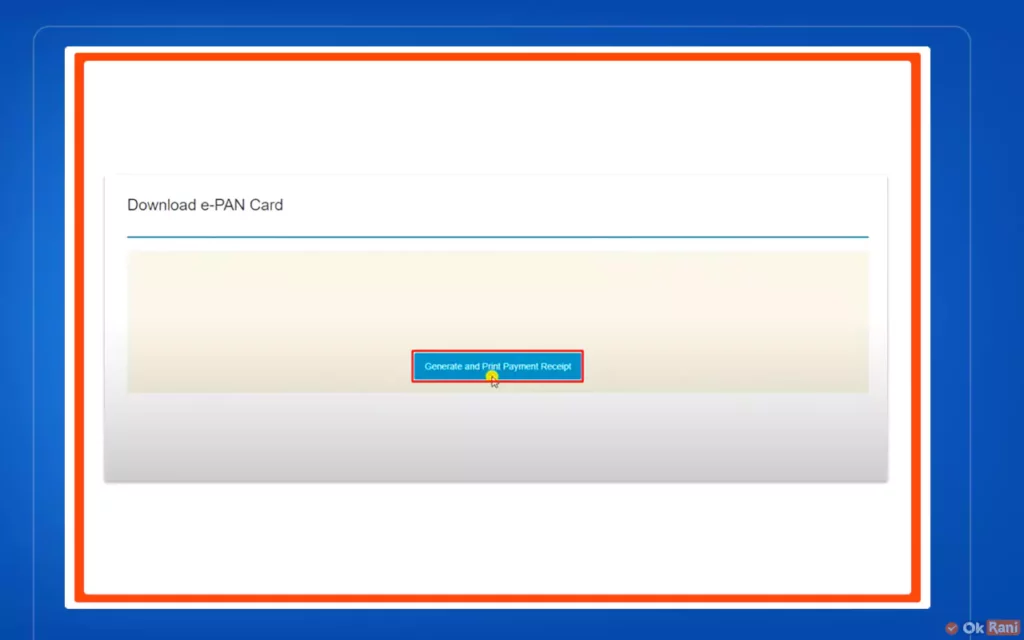

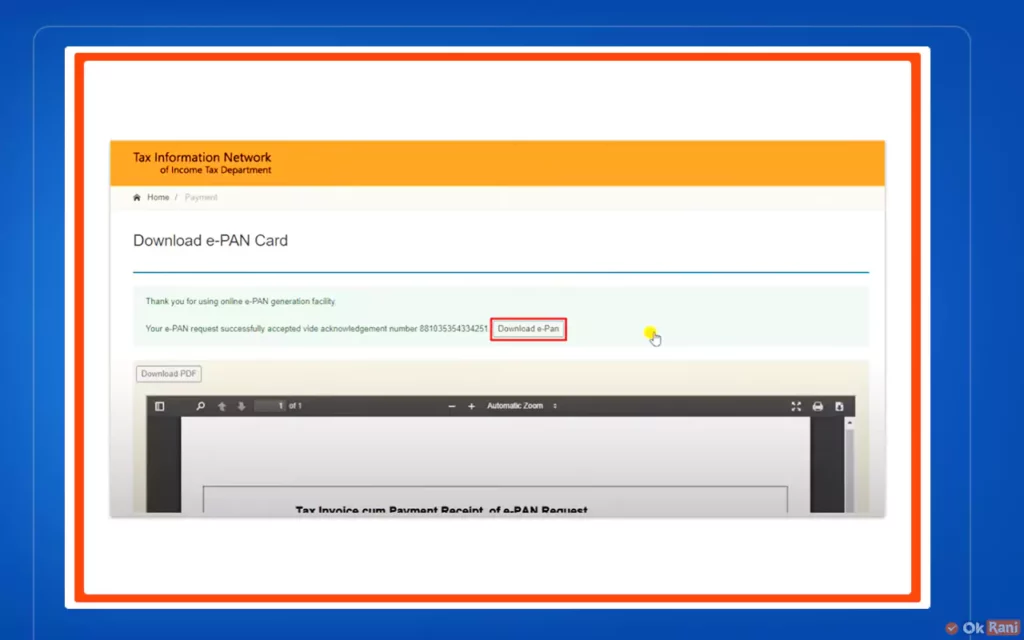

Step 7: On successful completion of payment, you will be redirected to the below page. Click on the continue button to Generate and print the payment receipt.

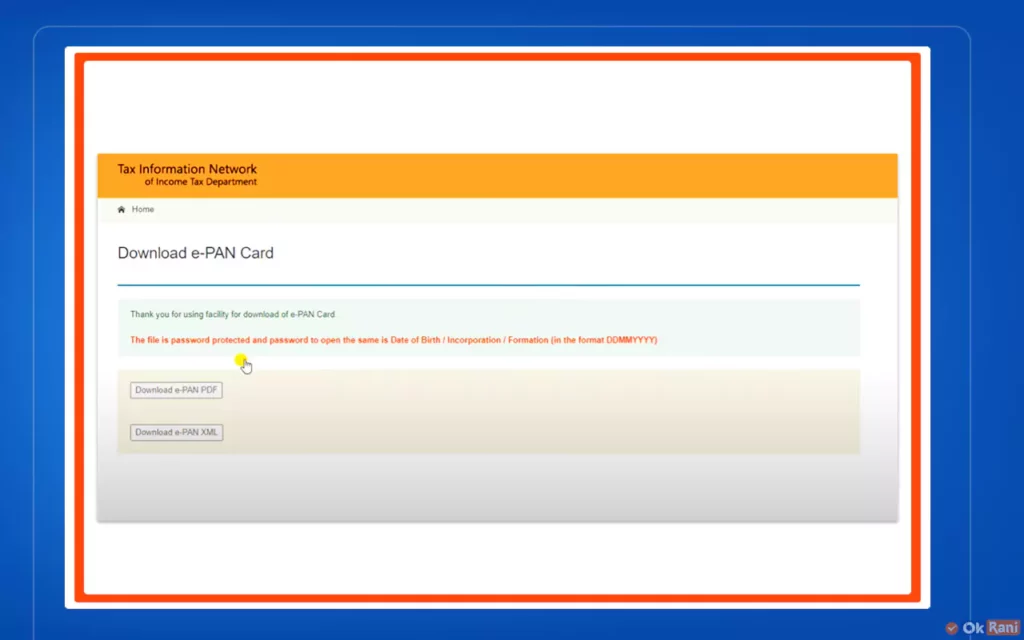

Step 8: Finally you can click on the Download e-PAN button to Download it as a PDF or XML.

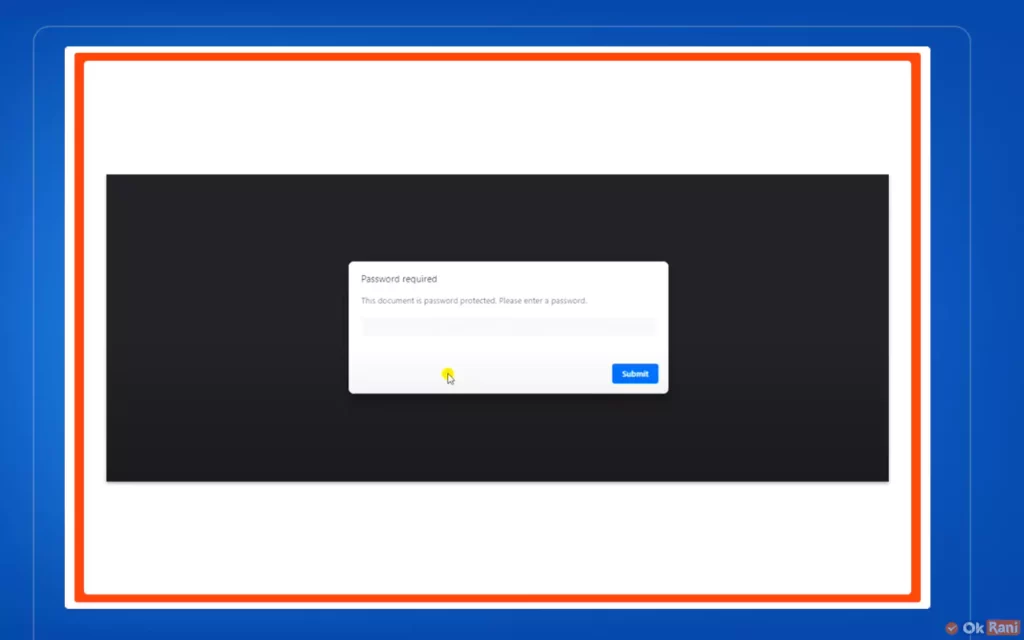

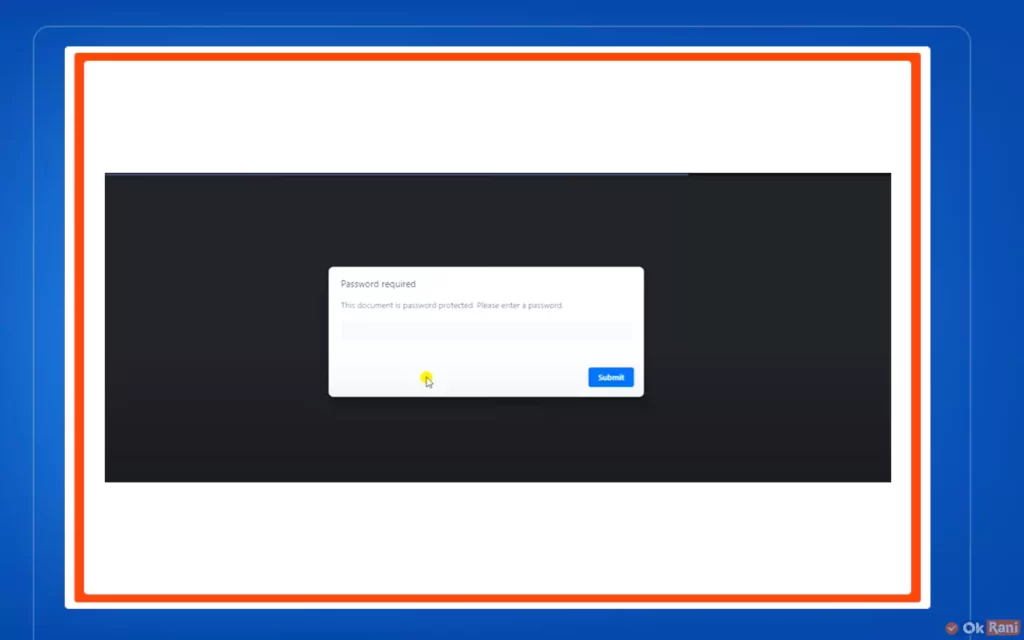

Step 9: Your PAN card download is secured with a password that is your Date of birth.

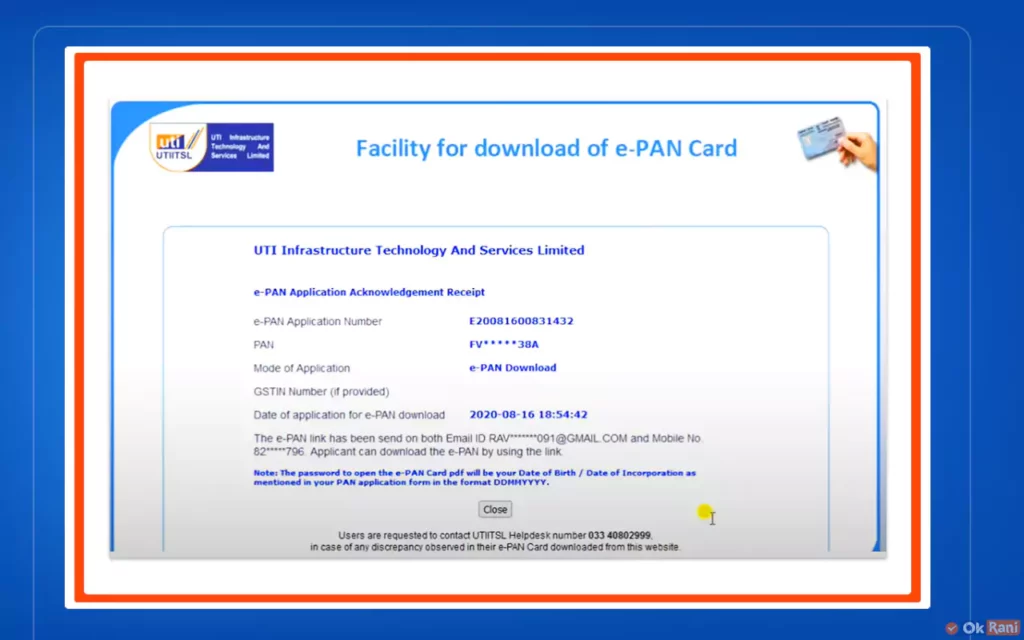

UTIITSL PAN card download

The UTIITSL portal offers the facility for UTI PAN card download for applicants who applied through their website. New PAN applications or those requesting changes can be downloaded at no cost within 30 days of confirmation from the income tax department. After this period, additional charges apply.

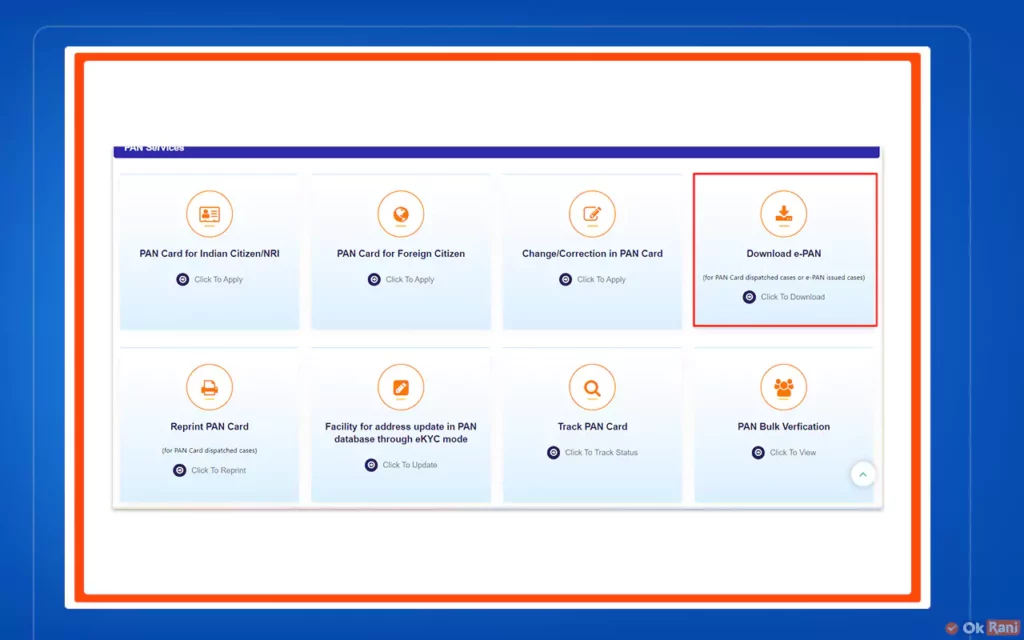

Step 1: Go to the official website UTIITSL portal and click on the Download e-PAN menu.

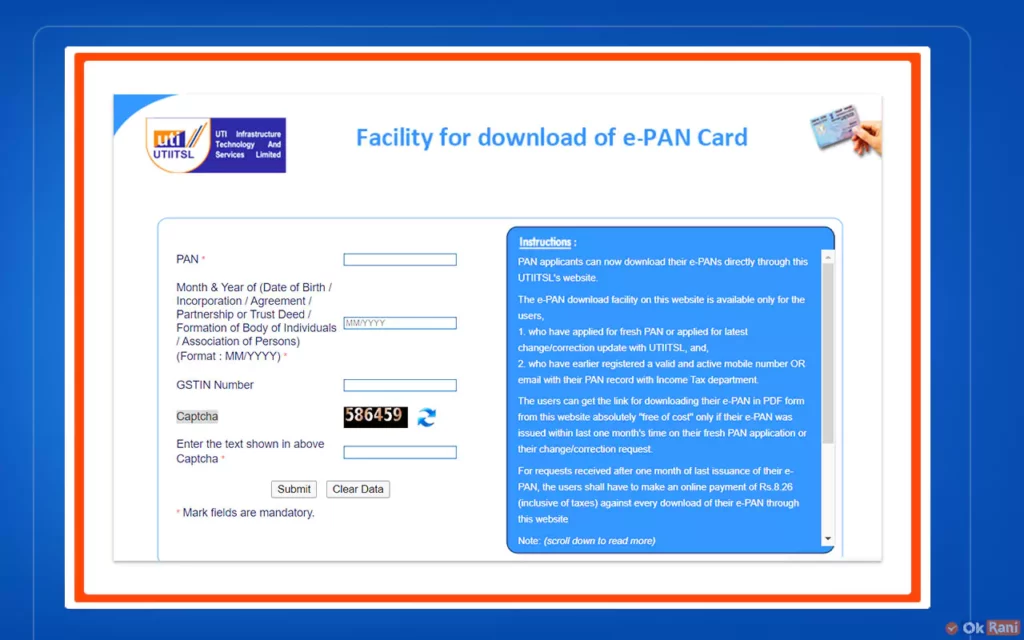

Step 2: Now fill in the required details like PAN number, Date of Birth, and Captcha, and click on the submit button.

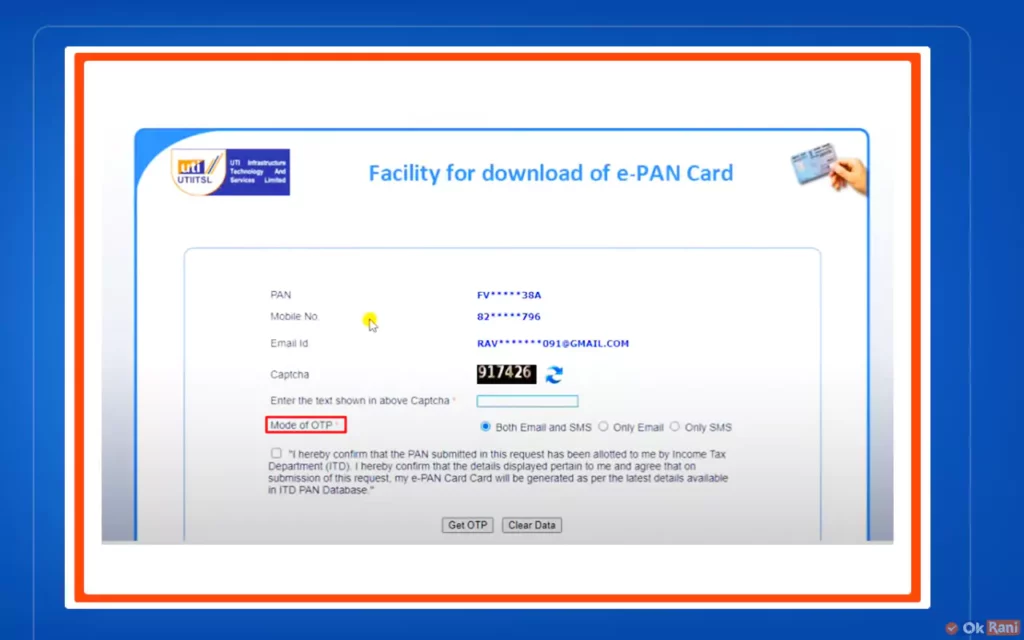

Step 3: After submission, the details will be displayed on the screen such as PAN, mobile number, email id and enter the captcha, and click on the mode of OTP checkbox to get the OTP.

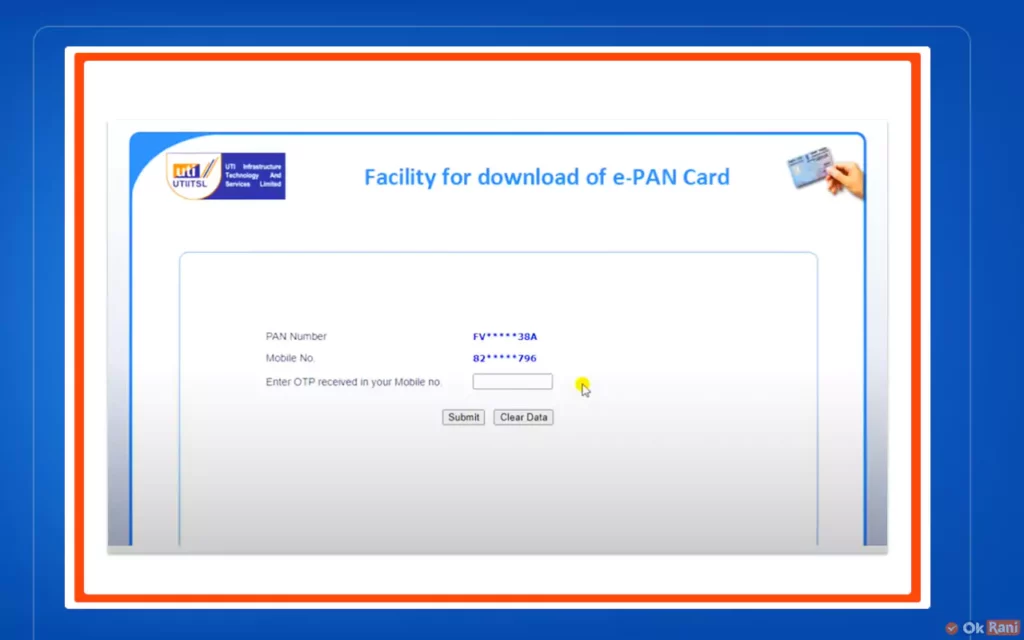

Step 4: Enter the OTP, you have received in the OTP column given.

Step 5: On this page, it will be displayed that “THe e-PAN has been sent on both email id and the mobile number”. You can download it from there.

Step 6: Your PAN card download is secured with a password that is your Date of birth.

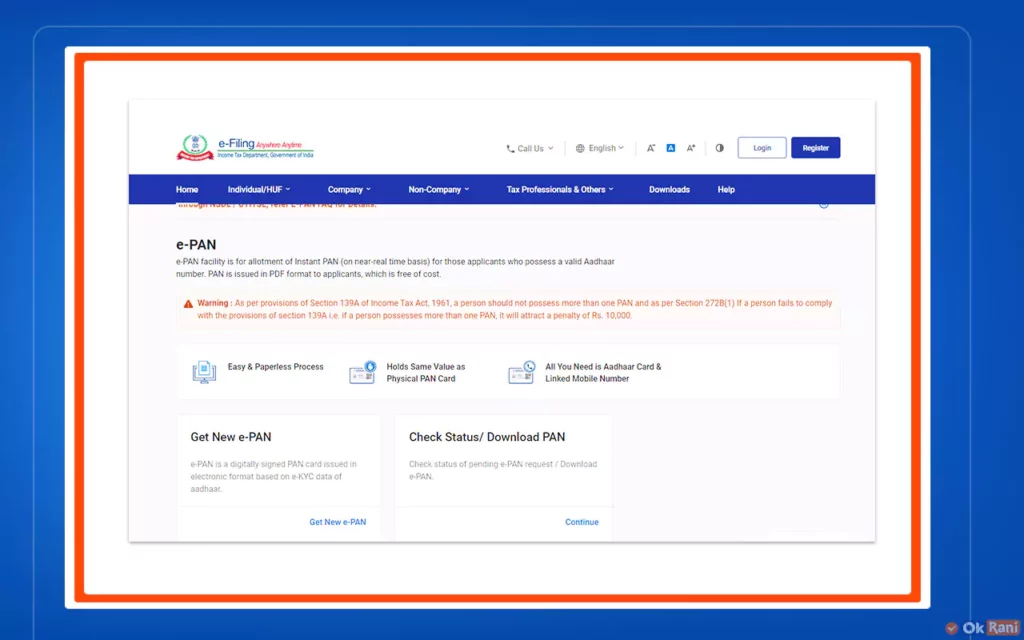

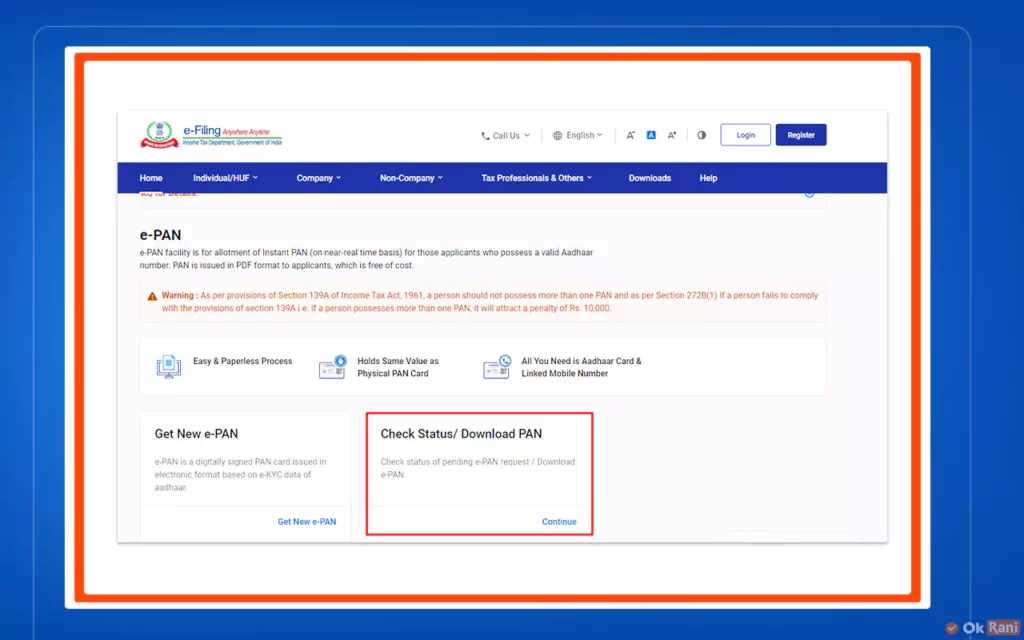

E-filing PAN card download

You can get your e-PAN card by downloading it from the Income Tax e-filing website if you applied for an instant e-PAN using your Aadhaar number on the same website.

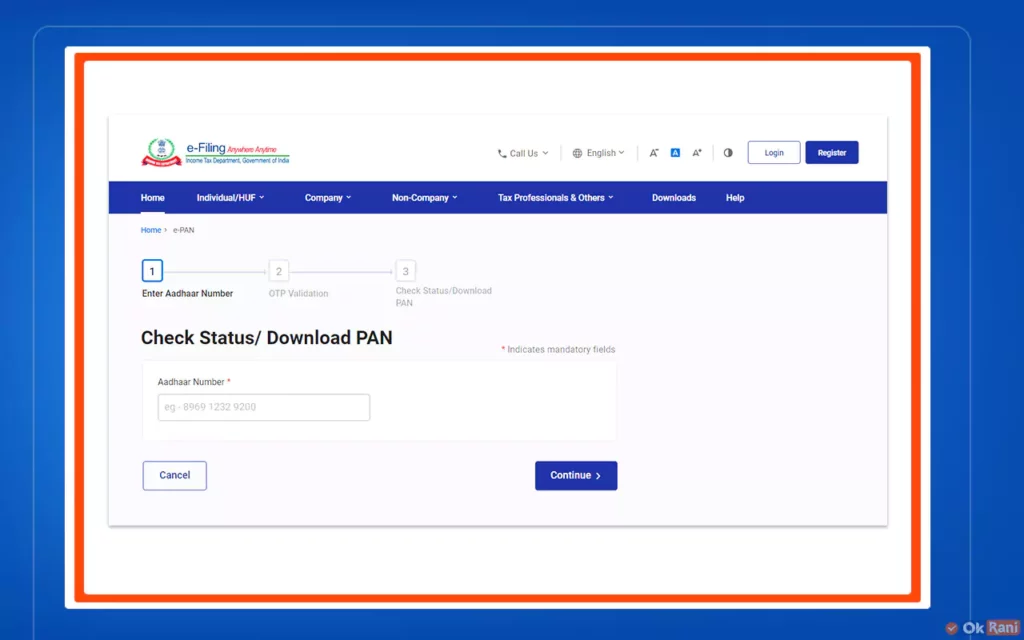

Step 1: Go to the official Income Tax E-filing Website.

Step 2: Click on the Check status/Download PAN menu.

Step 3: Enter your Aadhaar Number and click on the continue button.

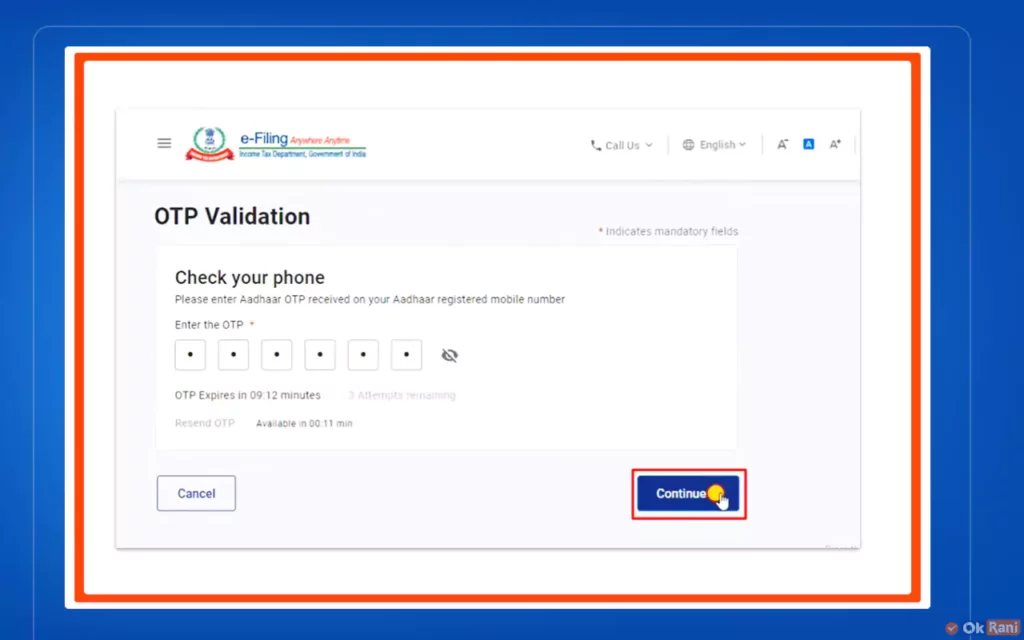

Step 4: Now enter the OTP associated with your PAN card and click on the Continue button.

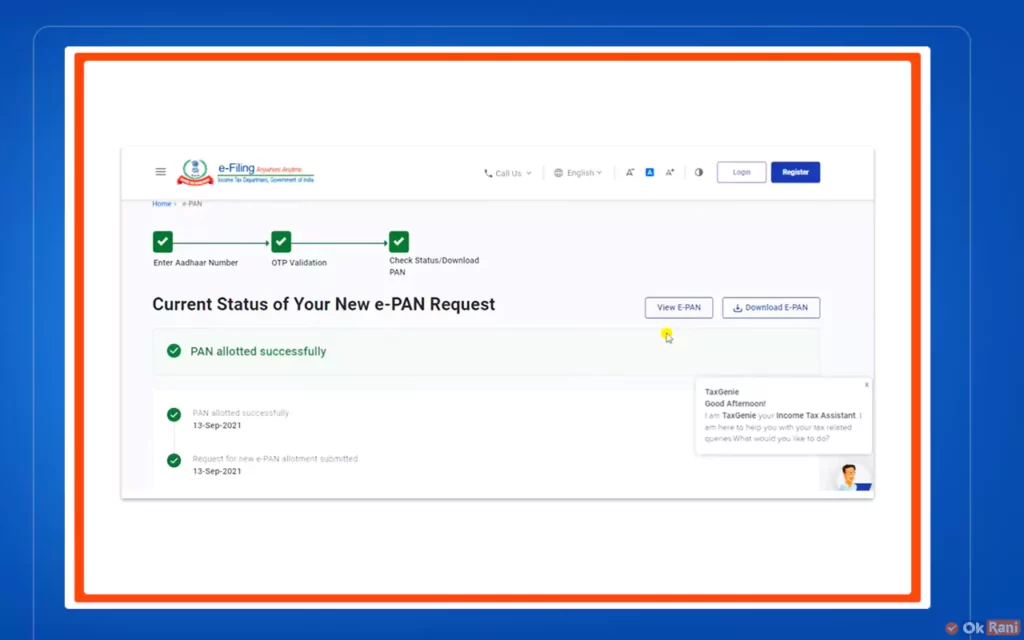

Step 5: After page navigation, you can download your e-PAN.

1) How to download a PAN card?

You can choose any of the above-preferred methods to download your PAN.

2) Can I download my PAN card multiple times?

Yes, you can download your e-PAN multiple times if needed. There is no restriction on the number of downloads.

3) What format is the e-PAN card available in?

The e-PAN card is available in PDF format, which is a widely used and easily accessible file format.

| Read More: How to Download Aadhaar Card? |