The Employees’ Provident Fund, commonly known as EPF, serves as a widely used retirement savings scheme for employees in India, whether it’s a mandatory or voluntary arrangement. The Employees Provident Fund Organisation (EPFO), a statutory agency in charge of fund management, is in charge of monitoring the administration of EPF. The EPFO periodically reviews and modifies the regulations governing PF withdrawals in an effort to improve the experience of its large subscriber base and expedite the procedure. Online PF withdrawals typically take 3 working days, however offline PF withdrawals might take up to 20 working days. Now let’s examine the revised guidelines for 2023.

Table of Contents

EPF Withdrawal Guidelines 2023

- You can’t take out your PF money, whether in full or in part, while you’re currently working.

- If you’re without a job for at least one month, you can withdraw up to 75% of your funds. If you remain unemployed for two months or more, you can take out the rest.

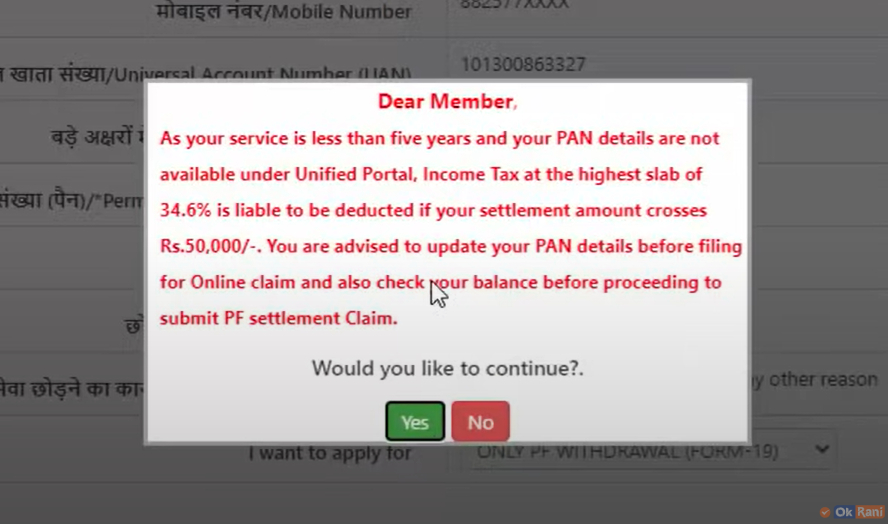

- If you plan to withdraw ₹50,000 or more within 5 years of opening your EPF account, there will be a TDS of 10% (with a valid PAN card) or 30% (without a PAN card).

- To avoid TDS deduction, you can fill out either Form 15H or Form 15G.

- You might be eligible for a loan against your PF savings if you’ve been continuously employed for a certain number of years.

- When changing jobs, you don’t have to withdraw money from your old PF account to transfer it to the new one. You can do this as long as your Universal Account Number (UAN) is active, and you’ve submitted the necessary forms.

- You can take out your entire PF balance if you’ve been without a job for at least 2 months or if your new job’s start date is more than 2 months after your last working day at your previous organization.

Documents Required for PF Withdrawal

- Identity Proof.

- Address Proof.

- Universal Account Number (UAN).

- Cancelled Cheque with IFSC Code and Account Number.

- Bank Account Information.

- Personal Details.

Steps to Apply For EPF Withdrawal Online on UAN Portal

Step 1: Go to the UAN Portal.

Step 2: Enter your password and UAN to log in. After completing the captcha, click “Sign In”.

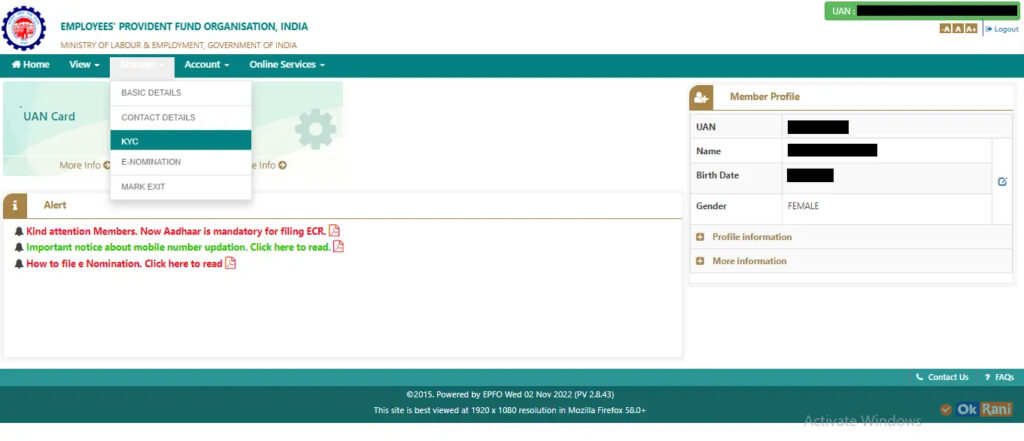

Step 3: Select “KYC” from the “Manage” option to see if your Aadhaar, PAN, and bank information have been validated as part of your KYC information.

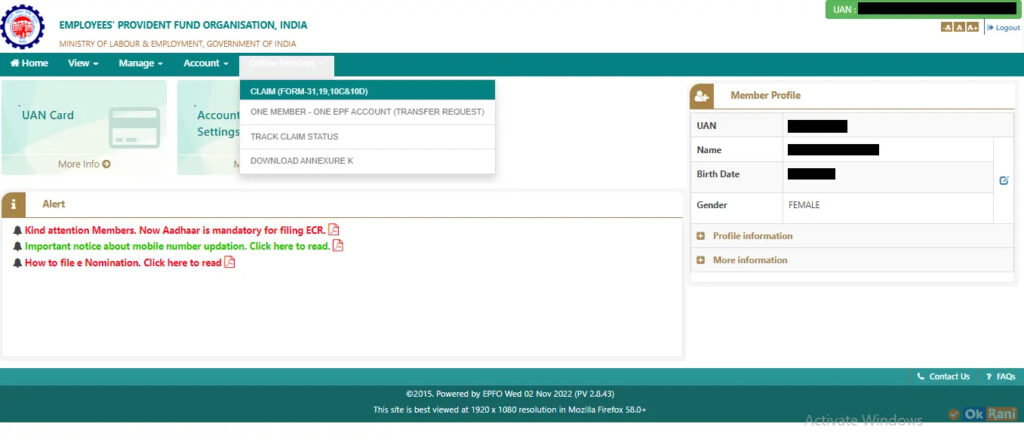

Step 4: After the KYC information has been validated, select “Claim (Form-31, 19 10C & 10D)” from the drop-down menu under the “Online Services” tab.

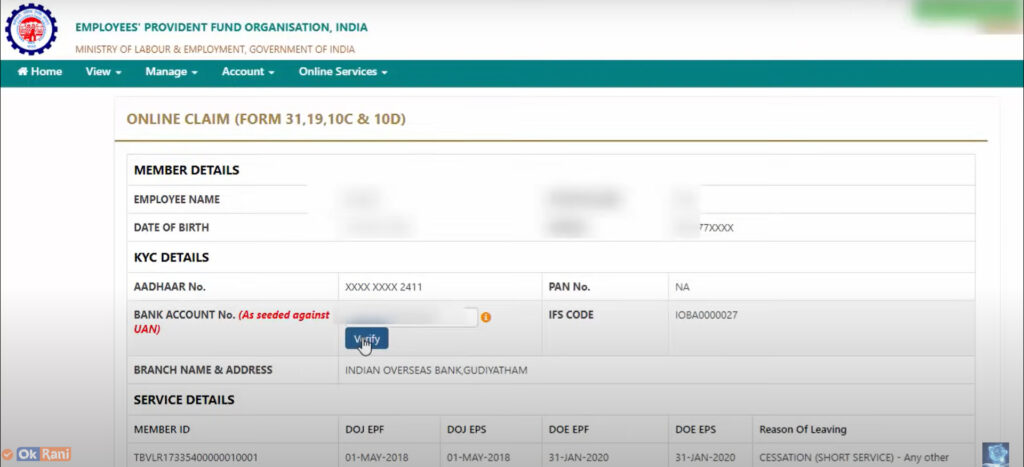

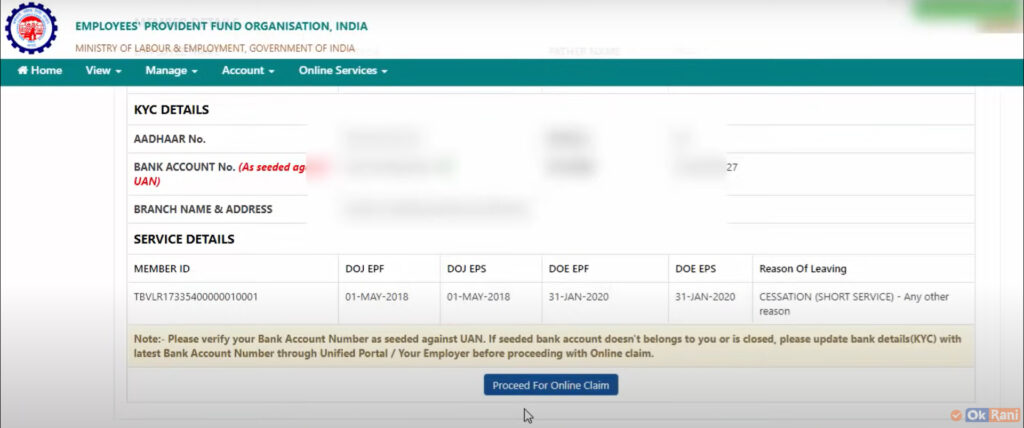

Step 5: The member details, KYC information, and other service information will be shown on the next screen. After entering your bank account number, select “Verify”.

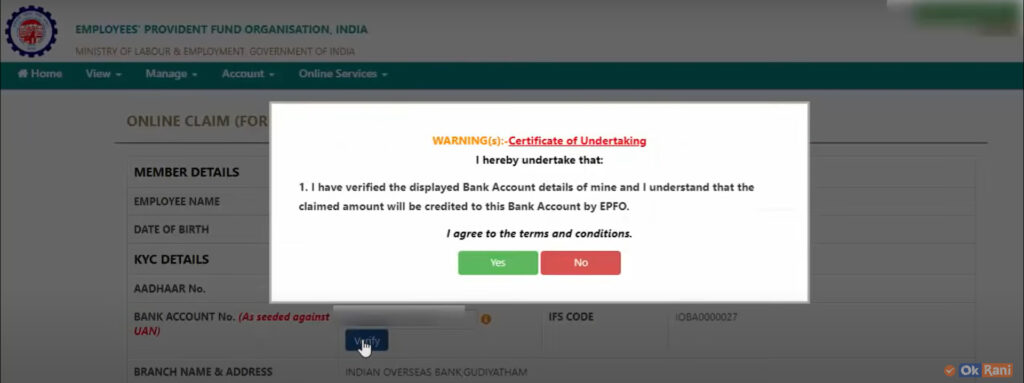

Step 6: Select “Yes” to proceed with signing the undertaking’s certificate.

Step 7: Now, Select “Proceed for Online Claim”.

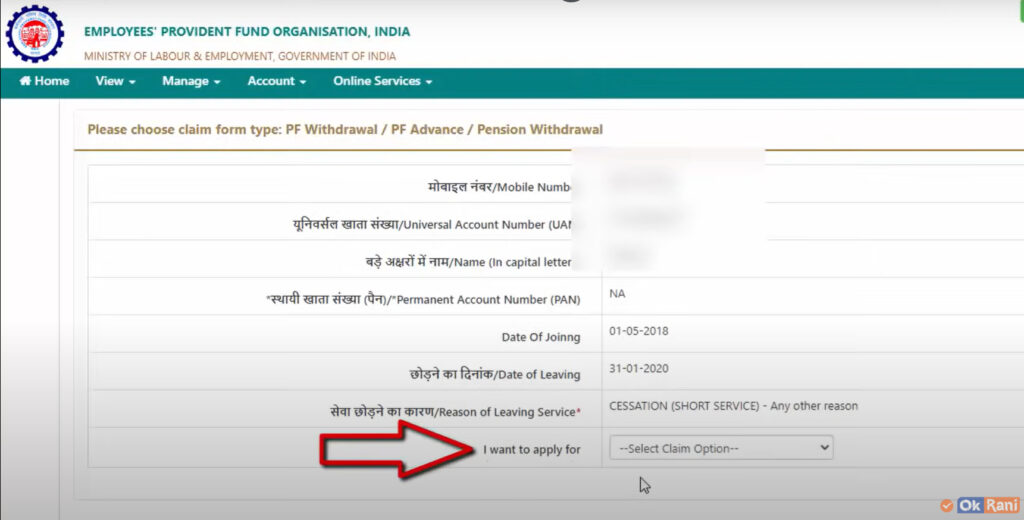

Step 8: Under the “I Want To Apply For” tab on the claim form, choose the type of claim you need, such as a full EPF settlement, an EPF portion withdrawal (loan/advance), or a pension withdrawal. The choice won’t appear in the drop-down menu if the member doesn’t meet the requirements for any of the services, such as pension or PF withdrawal.

Step 9: For the withdrawal of your money, choose “PF Advance (Form 31)”. Additionally, include the employee’s address, the desired amount, and the reason for the advance.

Step 10: Press the certificate to finish the application process. For the reason you filled out the form, you might be required to send scanned copies of your papers.

EPF Withdrawal through App

When using the online withdrawal method, employees can also use the Unified Mobile APP for New Governance (UMANG) to complete the withdrawal process conveniently on their phones.

The simplified online application procedure and UMANG’s services are designed to make the online EPF withdrawal process a convenient choice for people who need extra money to pay for certain necessities approved by the EPFO.

However, individuals can submit an offline application for an EPF withdrawal by printing a composite claim form and supplying the necessary information. Additionally, the employer’s permission attestation and self-attested documentation must be turned in to the regional EPFO commissioner.

When is it possible to Withdraw the PF Amount?

1. Complete EPF Withdrawal

You can withdraw your entire EPF under the following situations:

- Retirement: When an individual retires, they have the option to withdraw their entire EPF balance.

- Unemployment for Over Two Months: If a person remains unemployed for more than two months, they can initiate an EPF withdrawal. However, it’s important to note that an attestation from a gazetted officer is required in this case.

- Interim Period Between Jobs: During the period between changing jobs, if someone has not been unemployed for at least two months, they cannot withdraw their entire EPF balance. The option is available only when there is a continuous unemployment period of two months or more.

These circumstances outline the conditions under which one can completely withdraw from their EPF account, ensuring financial flexibility in alignment with specific life events.

2. Partial EPF Withdrawal

| Purpose | Tenure | Maximum Amount |

|---|---|---|

| House Construction or Purchase of Plot | 5 years | Up to 24 times the monthly salary for purchase or 36 times for purchase and construction. Alternatively, it can cover the cost of the property or the total of the employee and employer’s shares with the interest amount, whichever is less. |

| Home Loan Repayment | 3 years | Up to 90% of the PF balance |

| House Renovation or Alteration | 5 years from the completion of the house construction | Up to 12 times the monthly salary |

| Marriage | 7 years | 50% of the employee’s contribution with interest |

| Medical Treatment | Not required | Employee’s share with interest or 6 times the monthly salary, whichever is lower |

| FAQs – How to Withdraw PF Amount Online |

1. Can I withdraw my EPF amount without a PAN?

EPF withdrawal is possible without a PAN. If you choose to do this, though, the claim amount will have 30% TDS deducted from it.

2. Will I need the permission of my employer to withdraw my PF amount?

According to the new norms, you can withdraw the amount without the employer’s permission.

3. Is it possible to withdraw EPF at any time?

Only specific events, such as a physical condition, the marriage of the EPF account holder or his children, the acquisition or building of a home, or retirement, allow for the withdrawal of EPF.